Donate

Help us provide Help for Today. Hope for Tomorrow...® On this page, learn more about your donation options with the Alzheimer Society of Perth County. Monies raised will support people living with dementia, families and caregivers in your community!

You may make a general donation to our Society, or you may direct your donation to a specific program or to research. Please contact our office for more information at 519-271-1910 (toll-free:1-888-797-1882) or info@alzheimerperthcounty.com.

Why donate?

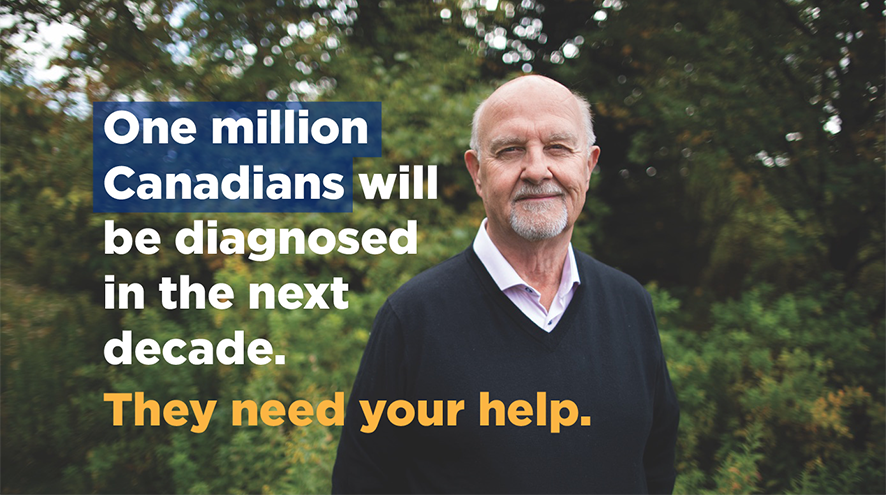

Making a donation to the Alzheimer Society of Perth County is investing in the health and well-being of our growing seniors’ community:

- Age is the biggest risk factor in developing dementia with current statistics showing that one in 11 Canadians over the age of 65 have Alzheimer's disease or another type of dementia.

- Families and caregivers who are informed about the disease, treatment options, risk factors and ways to manage difficult behaviours are better able to support the person they care for.

- They can also provide the best quality of life possible through the course of the disease than those who try to manage without support.

We depend on the generosity of our donors for more than 30% of our annual budget.

ALL of the donations to the Alzheimer Society of Perth County stay in Perth County to provide information, education, support and counselling services to affected individuals and their families and caregivers.

Donate online

Donate in memorium and in honour

Memorial donations honour the passing of a loved one or friend.

- Memorial donations can be made through a funeral home or directly to the Alzheimer Society of Perth County.

- The Society will send a note to the family informing them that a donation has been made by you in memory of their loved one.

Tribute donations can be made to the Alzheimer Society of Perth County in honour of a birthday, wedding anniversary, retirement or any special occasion.

- Receipts can be issued either in the donor's name or in the name of the individual you wish to honour.

- A note will be sent to the individual informing them that a donation has been made in their honour.

- Please ensure that you include name and mailing address of the individual you are honouring as well as any special messages you wish included.

Donate in-kind

What is a gift in kind?

A gift in kind is a donation of goods or service rather than money. Some examples of a gift in kind include:

- Prize donations for events,

- Gift cards and certificates,

- Professional services and

- Gifts of property, like artwork.

Gifts in kind help the Alzheimer Society of Perth County by enhancing events, reducing necessary expenses and contributing to the Society’s assets.

Are gifts in kind eligible for a tax receipt?

Not all gifts in kind are eligible for a charitable tax receipt, as directed by the Canadian Revenue Agency (CRA).

When receiving a gift in kind, the Society’s policy is as follows:

Prize donations

Tax receipts for prize donations will only be given at the specific request of the donor. Documentation indicating the fair market value of the item must be provided by the donor.

Donation of gift cards and certificates

Tax receipts will not be given for the donation of gift cards and gift certificates; however, the Society will provide a letter of acknowledgment.

Donation of services

Tax receipts will not be issued for donations of services; however, it is acceptable for a person who has been paid by the Society for services rendered to then make a donation for which a receipt shall be issued.

Gifts of property

For gifts of property, the Society will follow the following procedure:

- The Society shall accept gifts of property only with the approval of the Executive Director.

- An official income tax receipt shall be issued for gifts of property only up to the fair market value of the goods donated. If the fair market value of an item can be reasonably determined and is less than $1,000, a staff member with sufficient knowledge of the item can determine its value. If the fair market value of an item cannot be reasonably determined, an official donation receipt cannot be issued.

- All gifts in kind with a fair market value in excess of $1,000 shall be accompanied by a credible valuation report prepared by a professional appraiser that states the fair market value (see below). If the gift-in-kind is not accompanied by a credible valuation report, the donor shall be advised about this Gifts-in-Kind policy and that it is their responsibility to secure an appraisal from an independent professional appraiser.

- Official income tax receipts for gifts-in-kind shall be issued in accordance with CRA requirements for official donation receipts.

Appraisal of Gifts is the professional evaluation of gifts-in-kind by a qualified appraiser to establish the fair market value for the issuance of tax receipts.

Fair Market Value generally means the highest price, expressed in dollars, that a property would bring in an open and unrestricted market, between a willing buyer and a willing seller who are knowledgeable, informed, and prudent, and who are acting independently of each other.

Send a Charity Gift Card

Give the Gift of Giving! Charity Gift Cards are perfect gifts and are easy to personalize and deliver.

With a Charity Gift Card, the recipient can go to CanadaHelps.org and support a charity of their choosing. Charity Gift Cards can be purchased through CanadaHelps.org.